To advance its goals of reducing emissions and promoting electrification, the U.S. government has implemented comprehensive legislation that may influence your decision when purchasing a new HVAC system. This includes updates to the minimum efficiency standards for new products and the introduction of new tax credits. We've summarized all the essential information you need to know.

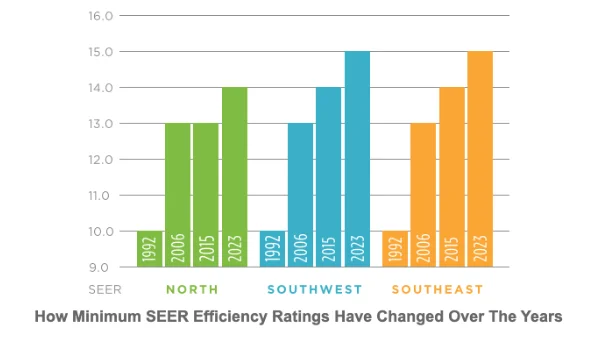

The Department of Energy (DOE) consistently reviews energy usage and sets higher benchmarks for minimum efficiency in heating and cooling systems. This not only reduces energy bills but also supports environmental sustainability.

The DOE has updated how it measures energy efficiency, adopting more rigorous standards. These changes aim to give you a more accurate representation of efficiency in typical home conditions.

Think of SEER (Seasonal Energy Efficiency Ratio) like fuel efficiency in cars. The higher the SEER rating, the more efficient the unit, similar to better mileage on the highway. An increase from the current minimum SEER ratings signifies improved efficiency and savings.

Investing in a unit with a higher SEER rating can significantly reduce your annual operating costs. For instance, upgrading from a 10 SEER to a 17 SEER system can save you up to 41% on your bills.

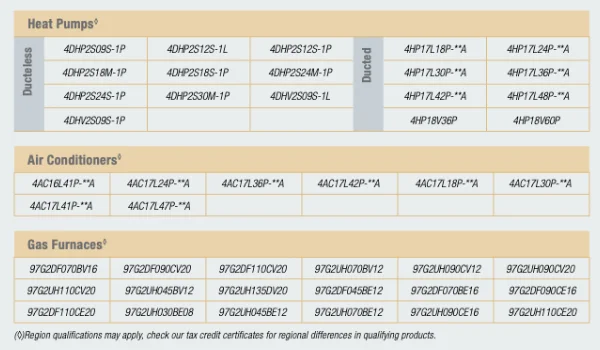

The Inflation Reduction Act of 2022 introduces tax credits for both heating and cooling systems, making energy efficiency upgrades more affordable.